It was Seth Godin who described marketing as a contest for people’s attention, and recently I’ve been pondering the different ways which Universities are attempting to grab the attention of potential students, particularly as the looming Federal budget looks almost certain to increase cost for students. The more students are required to pay for Higher Education, the more seriously many of them will take the choice of course and provider, and for that matter consider whether a Degree is even worth it (as I talked about in my last blog post). This pressure will no doubt have University marketing departments hot-to-trot on making sure that their University’s brand is being represented in the most enticing way possible, but across the 43 accredited Universities in Australia offering a highly regulated (and in many cases some would argue largely indistinguishable) product, how are Universities attempting to differentiate?

It was Seth Godin who described marketing as a contest for people’s attention, and recently I’ve been pondering the different ways which Universities are attempting to grab the attention of potential students, particularly as the looming Federal budget looks almost certain to increase cost for students. The more students are required to pay for Higher Education, the more seriously many of them will take the choice of course and provider, and for that matter consider whether a Degree is even worth it (as I talked about in my last blog post). This pressure will no doubt have University marketing departments hot-to-trot on making sure that their University’s brand is being represented in the most enticing way possible, but across the 43 accredited Universities in Australia offering a highly regulated (and in many cases some would argue largely indistinguishable) product, how are Universities attempting to differentiate?

This topic was covered well in Marginson’s ‘The Enterprise University‘ back in 2000, where one hypothesis (acknowledged as a pessimistic one) was that government and market pressures will homogenise Universities, and that the risk of failure by daring to be different would potentially cause mass isomorphism within the Australian Higher Education landscape. More than 15 years on from that prediction, have our Universities become indistinguishable to potential students in terms of the brands that are presented to them?

Have our Universities become indistinguishable to potential students in terms of the brands that are presented to them?

To get some sense of this, with some help from YEAH Local, I reviewed twenty different Australian-based University websites, with the aim of understanding just how different the marketing messages were across a good sized sample. I did this by extracting the text from three separate web pages within each University’s website, namely:

- The ‘About us’ page (or equivalent, giving a general overview of the University);

- The ‘Mission and Vision’ statements (or similar extracted from the Strategic Planning page); and

- The ‘Why study with us’ page targeting potential students.

The selection of Universities was largely random, or as random as a human can get simply by thinking up names of different Universities. Some Universities had to be excluded as their websites either had no meaningful information of this nature, or the information was so awkwardly structured that getting anything meaningful from it was more or less impossible (and they did exist, oh yes). Harvesting this content from each website gave between 500 and 1000 words, which I then fed into a neat little word cloud generator I found, at the same time excluding a variety of words:

- All common words (‘the’, ‘if’, ‘and’ and so on);

- All words that I considered ubiquitous to all Universities (‘University’, ‘student’, ‘degree’ and so on);

- The name of the University;

- Words relating to the city, state or country the University was operating in; and

- Any other words which added no meaning to the analysis without context (‘because’, ‘three’, ‘have’ and so on).

First up, I generated a cloud for all selected Universities combined, which looked like this:

No surprises that Research gets top billing, closely followed by ‘World’ (given the international focus of Australian Universities), and on the whole looking like a pretty good spread of words to reflect the purpose of a Higher Education system.

But is the picture uniform across all Universities?

To answer this question, I looked at groups of Universities, similar to the ones described by Marginson, but with some slight modifications, with the groups as follows:

- Group of Eight (Go8) Universities

- ‘Gumtree‘ Universities

- Industry/Technology Universities

- Regional Universities (not specifically RUN network members)

- Private Universities

Now granted, this grouping isn’t the only one I could have used – I could have also looked at IRU Universities, RUN Universities, ATN Universities, and I could have also swapped out the Go8 Unis into the more traditional ‘Sandstone’ and ‘Red Brick’ Universities – but I used these groups to get a quick and easy view of the current landscape.

Selecting twenty Universities was enough to let me have four in each category, and while I’ve no doubt got some subconscious bias in how I selected them, almost 50% of the overall cohort is a pretty decent representative sample. Once I’d done this, I generated a word cloud for each University and considered them together, and the results were quite interesting. Note that while I’m leaving the specific Universities I selected as anonymous, all of the information is publicly available, and anyone could perform a similar investigation if they were keen.

The Group of Eight

Not surprisingly, this was the most traditional and predictable group, probably because they can afford to remain strongly aligned with the ‘traditional’ view of an Australian University. Research. Rankings. World/Global/International focus. Teaching/learning. Three of the four are nigh-on identical, which makes for a very uniform market position for this elite group.

The Gumtrees

Interestingly enough, the four Gumtree Universities considered (created in the sixties or seventies, and typically located in outer suburbia or semi-bush locations) were barely distinguishable from the Group of Eight in terms of their market positioning. With the exception of the odd differentiator word relating to innovation, the environment or somewhat esoteric and emotive ‘hook words’, there really is very little to distinguish them from their Go8 cousins aside from ‘Rankings’ having a far smaller presence – no surprises on that one.

Industry/technology Universities

Things started to get a little more diverse with this group, and while the ‘Global’/’Research’/’Education’ trio still featured prominently, there were a far more diverse collection of words around it, including ‘Technology’, ‘Community’, ‘Industry’ and ‘Relevant’. The content from this group did appear to be looking to create some more concrete points of differentiation from the first two groups, but without completely letting go of the foundational elements of research and education in a global market.

Regional Universities

The regional Universities were where things truly started to get interesting, with the focus shifting away from research and ranking pedigrees, and much more towards what I consider a ‘student centric’ messaging focus – ‘Support’, ‘Community’, ‘Online’, ‘Help’, ‘Engage’, alongside plenty of education-focused words. It would be an interesting exercise for someone (not me) to correlate these student-centric concepts with student satisfaction ratings from QILT surveys to see if these proclamations translate into happy students. That aside, this group provided a very different, and diverse, set of positioning statements.

Private Universities

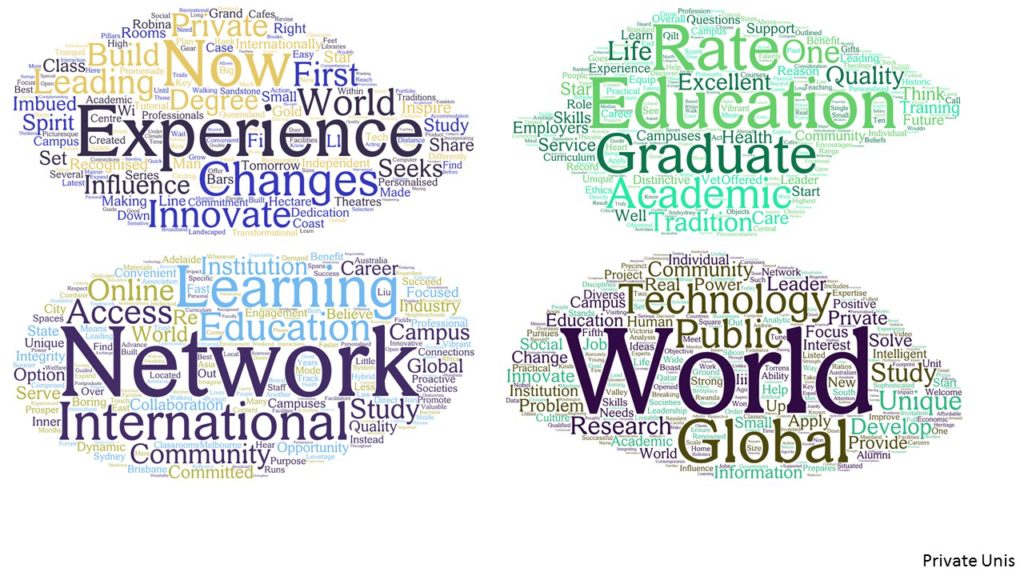

Given the small number of private Universities, this list is highly representative of the entire group in Australia. Like the regional Unis, this group provided a very diverse and very different messaging platform to attract students. Not surprisingly, research barely rates a mention, education features prominently, but beyond that they are quite different. The top two appear perhaps to focus more on the student experience, while the bottom two focus more on becoming part of a global network, which makes sense given the origins of some of the private Universities operating in Australia. The networking/connectivity also aligns with my earlier thoughts on networking and employability, which is interesting. Whatever the case, these represent a vastly different set of messages to those we started with in the Group of Eight.

So what can we take from all this?

From the Universities sampled, it would appear that Universities in Australia fall into one of several camps in terms of their market positioning. At one end of the spectrum we have the ‘traditional’ Universities, holding most of the cards in terms of research, hence rankings, hence prestige, and not looking like this will change unless radical changes to the sector occur. We then have the Gumtree Universities, aligning themselves as close as possible to the Group of Eight, but without the weight of rankings to back them up to the same extent – but without a doubt with each having their own plan to push as close to the Eight as possible. Perhaps this was the case fifty years ago with the Red Brick Universities attempting to unsettle the Sandstones, that would be an interesting question for the right historian to comment on. Next we have the Industry/Technology Universities attempting to create a genuinely different market position but without completely waving goodbye to the research components of the Group of Eight. Finally, we have the Regionals and Private Universities, both of which have largely cast off the positioning of the University as the attractor in and of itself, and instead marketing more customer-centric concepts as attractors for new students, with the Private Universities in particular seeming the most willing to position themselves in a completely different light to the traditional University – as they should do in a competitive market.

Have all Universities ‘homogenised’ in their market positioning in 2017? Clearly not – however they have separated into a spectrum of sorts between the ‘traditional’ marketing of the University itself (in terms of its prestige against, in particular, research) being the drawcard and the more diverse and ‘customer focused’ positioning, where customer experience rather than prestige is the message.

As the cost of education borne by students increases, these market positions – and the realities that sit behind them – will only become more important, underpinning the drive for continuous growth in a neoliberal Higher Education model.